That US monetary policy receives attention in discussions of international spillovers and the global financial cycle is not surprising, given the centrality of the US dollar in the international financial system.

Helene Rey's influential works including at the 2013 Jackson Hole meeting (Rey 2015) and the 2014 Mundell Fleming Lecture (Rey 2016) raised important challenges about country toolkits. In recent years, both have received attention in previous Mundell Fleming Lectures.

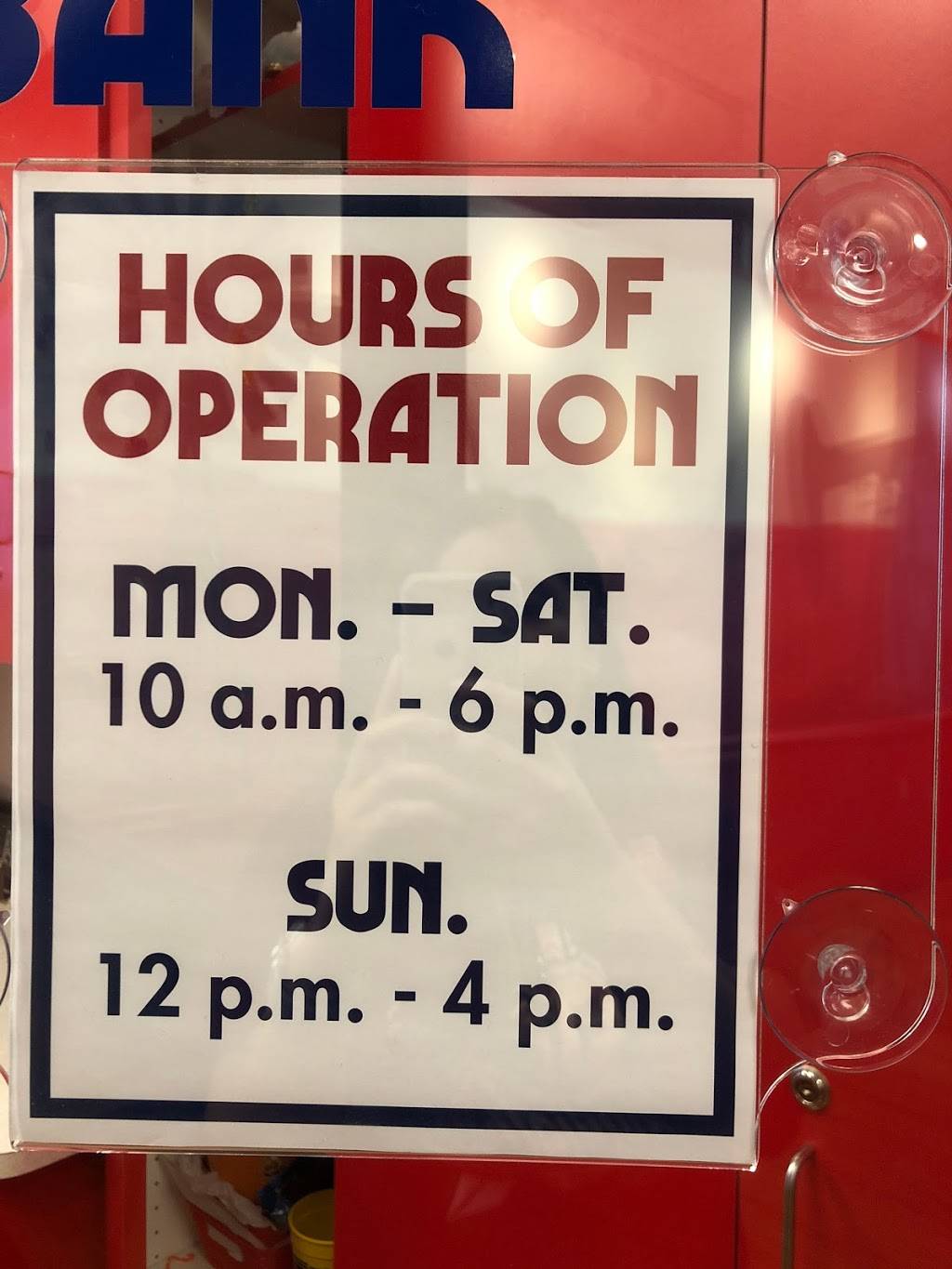

#First convenience bank drivers

Two drivers of this private global liquidity are monetary policy changes, including those from the US, and risk conditions. I take the position that global liquidity is central to the financial stability considerations. Within this space, my perspective is one shared by many previous Mundell Fleming Lecture presenters - with exchange rates determined in response to international capital flow pressures, and with financial factors the dominant driver. Global liquidity is central to international macroeconomics, especially around international spillovers, monetary policy, capital flows, and credit provision. It is proxied by the volumes of financial flows, largely intermediated through global banks and nonbank financial institutions, that can be reallocated at relatively high frequencies (can be intra-day or even intra-month). It reflects the behavior of the financial sector in providing cross-border and/or foreign currency financing. Private liquidity refers to the funding conditions for the broader international economy. Official liquidity is that component created by central banks. In 2011, the Bank for International Settlements (BIS) defined two types of global liquidity (CGFS 2011): Today, my remarks focus on the topic of global liquidity.

My remarks today also will discuss these tradeoffs and toolkits, working through insights around global liquidity. Research and analytics inform the prospects and challenges around specific domestic tools-including macroprudential measures (MPMs), foreign exchange intervention (FXI), and capital flow management measures (CFMs). Countries face difficult tradeoffs in policy. The extensive work of the IMF on the Integrated Policy Framework (IMF 2020) is an important step forward. Importantly, as a community we think about the design, scope, and efficacy of policy toolkits available to countries, and frameworks for when and how different tools are utilized. The stamps of such rich perspectives are reflected in the broader work of the IMF Research Department, and of the Monetary and Capital Markets Department. I will tie some of my key points to some history of thought showcased here at the IMF in past Mundell-Fleming Lectures. In developing my own comments for this lecture today, I follow Maury's lead a bit. Likewise, by Maury's capacity to position his observations into the broader contributions of diverse thought-leaders, taking sweeping views of the history of thought on these topics. I am personally inspired by Maury's scholarship and intellectual integrity, and his deep thinking about big picture questions of the entire international monetary system. I will discuss this granularity, but from an empirical perspective.

Pierre-Olivier showed how theory is increasingly able to incorporate economic and financial granularity: networks, frictions, heterogeneity. Some foundational contributions are in modelling inter-temporal considerations - for example with his work with Ken Rogoff on New Open Economy Models, which served as the starting point for Pierre-Olivier Gourinchas's Mundell-Fleming Lecture last year ( Gourinchas 2021). Maury has made so many deeply insightful contributions to our understanding of international monetary history and international finance. It is a special privilege to be at this 23rd Jacques Polak Conference, as during these two days we honor Maurice Obstfeld, an economist for whom we all have tremendous respect. I speak today on my own behalf, and the views expressed do not necessarily reflect those of the Federal Reserve Bank of New York or the Federal Reserve System. You are united in your commitment to a well-functioning international monetary system, to strong economies around the world, and to addressing those vulnerabilities that limit the ability of countries to obtain their best outcomes. Thank you Pierre-Olivier Gourinchas (Economic Counsellor and Director, Research Department, IMF) for your generous words of introduction. Thank you Kristalina Georgieva (Managing Director, IMF) and Gita Gopinath (First Deputy Managing Director, IMF) for this honor. Under any circumstances it is an honor to present the Mundell-Fleming Lecture of the IMF Annual Research Conference.

0 kommentar(er)

0 kommentar(er)